Is Geothermal Power on the Brink of a Boom?

Source: Sonal Patel | POWER

An erupting geothermal geyser showing areas of geothermally altered ground. Photo credit: Sigurdur William Brynjarsson/Geothermal Resources Council.

After several years of stagnancy, prospects for the geothermal power industry are heating up. Over the past year, it has seen a flurry of legislative boosts, an uptick of power purchase agreements, and increased research and development focus and funding.

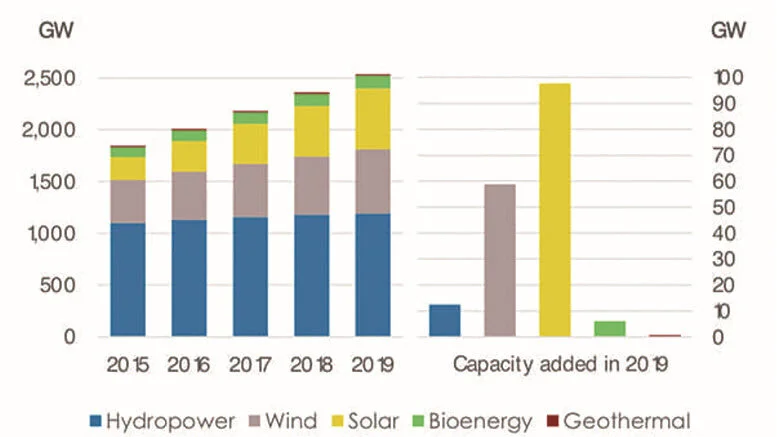

When visualized in the context of all renewable power capacity in 2019, geothermal power’s 14 GW contribution is a slim, almost invisible sliver of the 2,537 GW global total. Yet, as a renewable power source, geothermal’s technical potential is thought to be substantially larger. In the U.S., which leads the world with an installed geothermal capacity of 2.5 GW—half of it built in the 1980s—the technical potential is 60 GW, according to the Department of Energy’s (DOE’s) comprehensive June 2019–released GeoVision study. Globally (Figure 1), technical potential is thought to range between 50 GW and 200 GW.

In 2019, the world’s geothermal power capacity stood at 13,931 MW—up 40% from 9,992 MW in 2010, according to the International Renewable Energy Agency (IRENA). In 2019, 682 MW of new capacity came online, with Turkey leading the expansion (232 MW); followed by Indonesia (185 MW); Kenya (160 MW); Italy (33 MW); and the U.S. (14 MW). Courtesy: IRENA

The slow cumulative growth of the resource has been a cause of concern for its advocates because on its face, it is the perfect renewable. Whereas wind and solar intermittency require reactive flexibility measures, geothermal can provide baseload power and heat. But it can also complement other renewables, providing grid reliability, resiliency, and security both through traditional services, such as regulation reserve, frequency response, and contingency reserves, and nontraditional services, such as flexible capacity voltage control, inertia, and black-start capabilities.

Asked why geothermal’s uptake has lagged behind other renewables despite its obvious benefits, Will Pettitt, executive director of international industry trade group Geothermal Resources Council (GRC), pointed to several concerns. The most glaring is that geothermal has been typically limited to areas with suitable hydrothermal reserves. As significantly is that geothermal power development requires relatively high upfront capital costs and carries sizable investment risks because of long project lead times and payback periods. Good market conditions are crucial to help it thrive, Pettitt told POWER in March. Compared to the 1980s, for example, when about 100 MW of geothermal capacity was added in the U.S. each year, installations have slowed, owing largely to their short geographical reach, declining wholesale power prices, and cutthroat competition with other renewables.

An Extraordinary Year for Geothermal

The past year, however, has been so remarkable for the industry that some insiders believe it is “on the brink of a boom,” Pettitt noted. The DOE’s GeoVision study, which essentially outlined specific improvement scenarios that could expand geothermal deployment nearly 26-fold so that it would make up 57% of U.S. baseload renewable generation by 2050, was “like a call to action” to federal lawmakers. Last year a record three hearings on the resource were held on Capitol Hill, he said.

Ensuing legislation retroactively revived and extended the full production tax credit (PTC) for geothermal facilities that expired in 2017 through 2020. Congress has also crucially furnished the DOE with more funding to pursue development of enhanced geothermal systems (EGS) on top of the agency’s Frontier Observatory for Research in Geothermal Energy (FORGE) project in Utah. That project is one of two endeavors that are seeking to demonstrate EGS, which promises to tap into subsurface heat resources, and essentially remove geothermal’s geographical limitations, and advances it has made have already been applied in conventional systems. (The other project is being spearheaded by Bill Gates’ Breakthrough Energy Ventures.)

A key initiative of federal EGS research involves improving costs associated with drilling and well construction. As the National Renewable Energy Laboratory’s (NREL’s) Kate Young explained to the Senate Committee on Energy and Natural Resources last year, the cost of geothermal development is split 50% on the surface (such as for power plants and piping) and 50% below ground. “Many of the below-ground costs are borne at the front end of the project development, which can make project financing challenging,” she said. “And though drilling and well construction activities are present in many industries, time and costs are significantly higher for geothermal.”

Because it typically involves boring into harder, hotter rocks, with more lost circulation, geothermal drilling “averages about 150–200 feet per day, compared to oil and gas wells that average more than 750 feet per day, and sometimes are as fast as a mile a day (a.k.a. ‘MAD’ wells),” she noted. But breakthroughs are possible with the right research focus and funding, such as have been achieved by the oil and gas industry, Young said.

So far, to boost geothermal drilling efficiency in the near-term, NREL has embarked on a number of measures, including holding its first collaborative workshop with oil and gas efficiency experts last year. Research is also underway to develop sensing electronics for data collection, and machine learning to improve geothermal reservoir management. As critically, NREL is focusing on materials development for well construction, which poses another significantly high cost of geothermal development.

The developments promise insights for EGS, as well as for advanced geothermal systems (AGS), another set of technologies that could reshape geothermal’s trajectory. AGS essentially uses horizontal drilling techniques borrowed from oil and gas to drill small, sealed horizontal boreholes between wells to allow for circulation of fluids that bring the heat to the surface. “Modeling suggests this can be done feasibly with temperatures as low as 150C,” Young said.

At least one project is showing good potential for AGS. This February, Calgary, Alberta–based Eavor Technologies’ completed and third-party validated a demonstration of its Eavor-Loop technology at the full-scale Eavor-Lite facility (Figure 2) near Rocky Mountain House in Alberta.

Read full article here.